On Establishing a Trading methodology part IV, we will discuss MAE and MFE and their value on the optimisation of a trading system or strategy.

MAE and MFE

John Sweeney on his book Campaign Trading (Wiley & Sons, 1996), and then in Maximum Adverse Execution, established the base for a statistical way to deal with stops, so to minimise risk without harming profits, by maximising the ratio Profit/Max Drawdown. The added advantage is that we end putting our stops at uncommon places so the chance the market takes them and resume the trend is much lower.

Sweeney basically contends that if the system’s entry rules are right, then it should differentiate between winners and losers. That is, the way it behaves an entry from beginning to end should be different for winners and losers.

Winning trades shall go not too far against us.

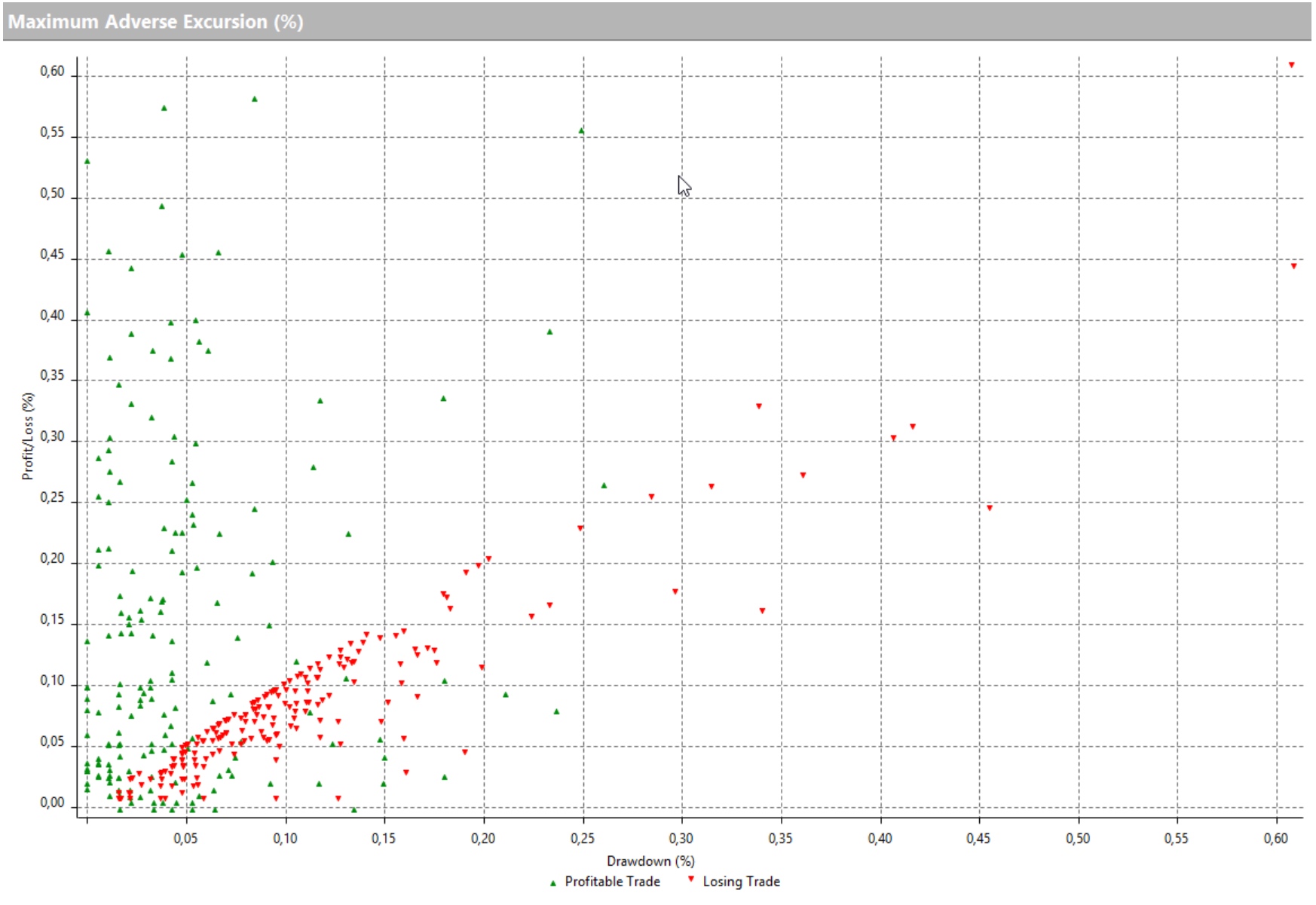

If we look at figure 1 (a DAX strategy with no stops), we could see there is a place where a stop could make a difference; between 0.15% and 0.20% euro, in this case. For sure, at least we would cut loses after the about 0.28% mark (X-Axis).

MAE

MAE is the maximum adverse price movement against the direction of the trade before resuming a positive movement, excluding stops. That is, We take stops out of this equation. We register the level at which a market turn to the side of our trade.

MFE

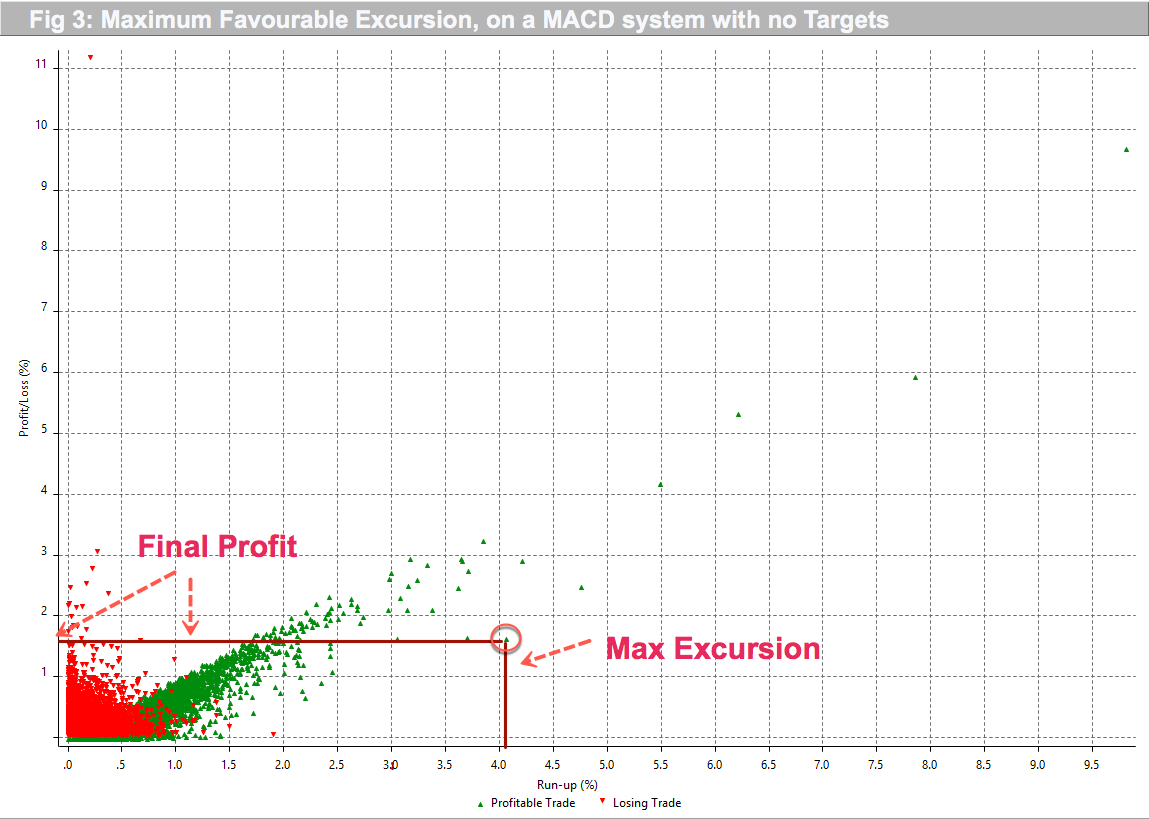

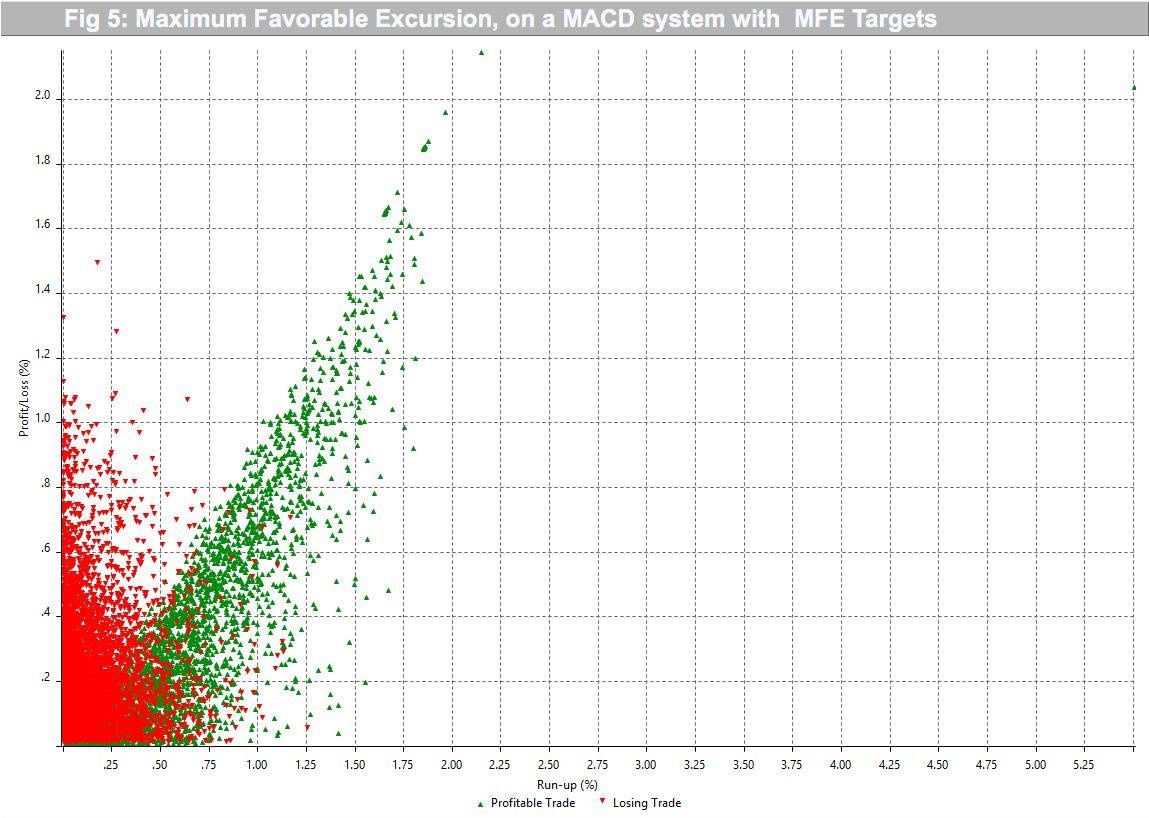

MFE is the maximum favourable price movement we get on a trade excluding targets. We register the maximum movement a trade delivers. We observe, also, that the red, losing trades don’t travel too much to the upside.

Using MAE and MFE Information

Having registered all these information, we can get the statistical evidence about how good our entry timing is, by analysing the average distance our profitable trades has to move in the red before moving to profitability.

If we pull the trigger too early, we will observe an increase in the magnitude of the mean distance together with a drop in the per cent of gainers.

If we enter too late, we may experience a minimal average MAE, but it is hurting our average MFE. Therefore, a minute MAE together with a lousy MFE shows we need to reconsider earlier entries.

We can, then, set the invalidation level that defines our stop loss at a statistically significant level instead of a level that is obvious for any clever market participant. We should remember that the market is an adaptive creature. Our actions change it. It’s a typical case of the scientist influencing the results of the experiment by the mere fact of taking measures.

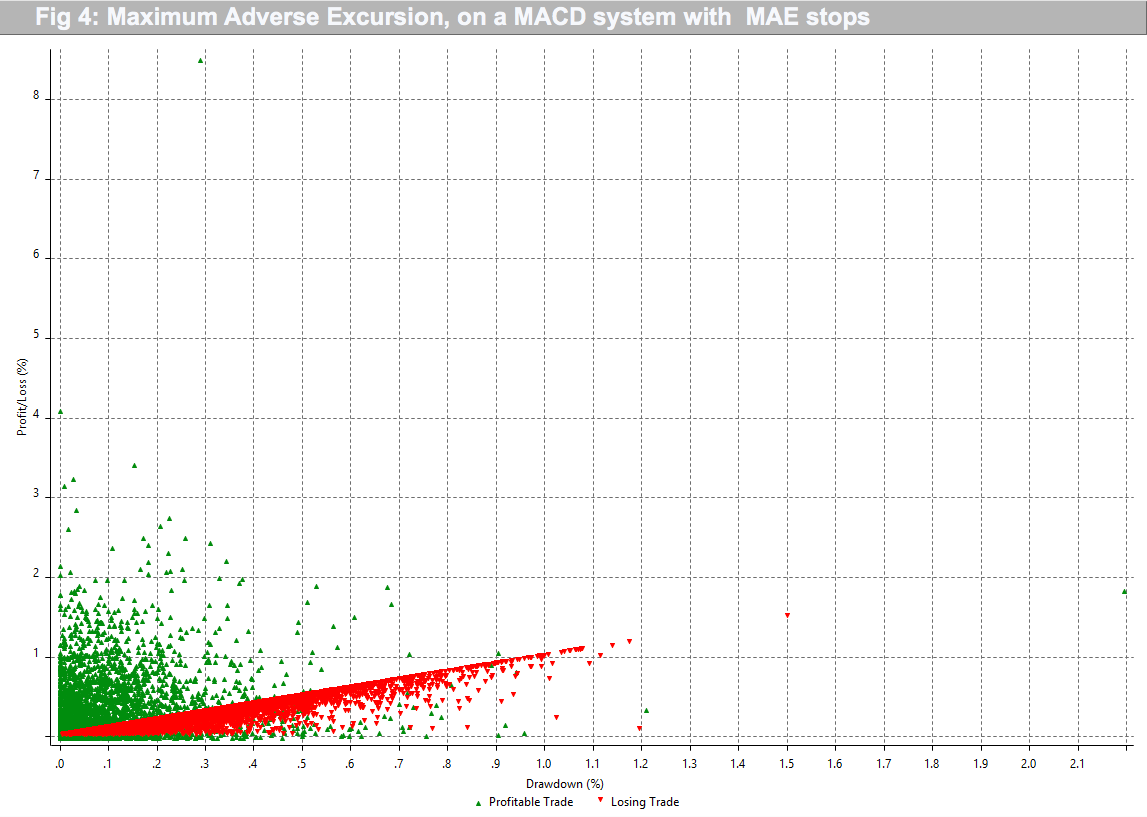

Optimising stops with MAE

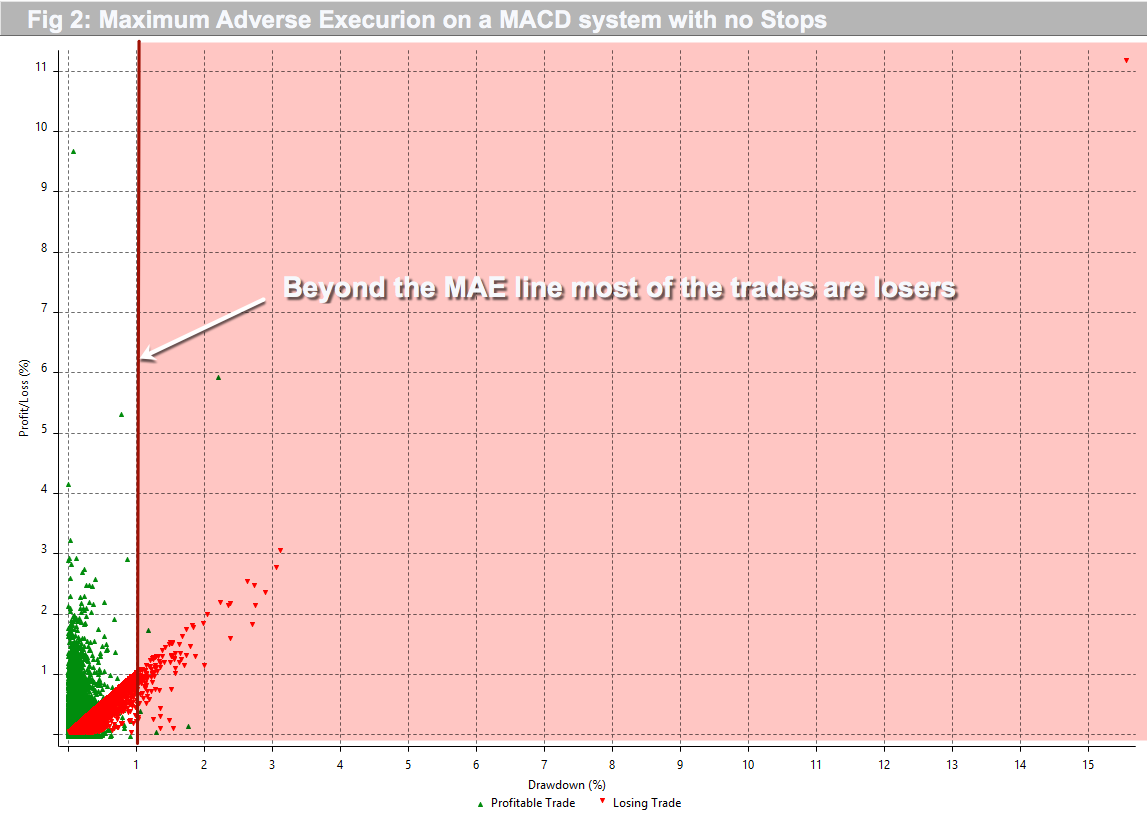

Let’s have a look at a MAE graph of the same system after setting a proper stop loss:

Now all losing trades are mostly cut at 1.2% loss about the level we set as the optimum in our previous graph (Fig 2).

When this happens, we suffer a slight drop in the per cent of gainers, but it should be tiny because most of the trades beyond MAE are losers. In this case, we went from 37.9% winners down to 37.08% but the Reward risk ratio of the system went from 1.7 to 1.83, and the average trade went from $12.01 to $16.5.

Optimising targets with MFE

In the same way, we could do an optimisation analysis of our targets:

We observed that most of the trades were within a 2% excursion before dropping, so we set that target level. The result overall result was rather tiny on this case. The Reward-to-risk ratio went up to 1.84, and the average trade to 16.7

To recap. MAE and MEF are valuable technics that help us fine-tune our system using the statistical properties of our trades, together with a visual inspection of the latest entries and exits in comparison with the actual price action.

—————–

Take your trading to the next level with our 14 Day, No Obligation, Free Trial. You will soon discover why we are trading’s best-kept secret. We are successfully building the world’s largest group of profitable traders and would like you to be part of it.

You can join for as little as $19.99 per month, no contract, cancel anytime. This amount can be covered with just one profitable trade with us per month, the rest is pure profit. You will benefit from unparalleled access to our professional traders, our transparent trading performance, our LiveTradeRooms and access to the most comprehensive trading education on the market. What have you got to lose? JUST CLICK HERE TO GET STARTED NOW and see how real money is made!