On Establishing a Trading methodology Part III we will explain why we need to keep a record of the performance of our strategy or system.

Deciding that a Trading System has an edge, isn’t a matter of evaluating the last five or ten trades. Even, evaluating the previous 30 trades is not conclusive at all; and changing erratically from system to system is worse than a random pick. That happens because, as we already stated, people tend to switch to another strategy at the worst possible moment: when the system has underperformed for some time.

No system is perfect. At the same time, the market is dynamic. This week we may have a bull and low volatility market and next, we are stuck in a high-volatility choppy market that threats with depleting our account.

We, as traders, need to adapt the system as much as is healthy. However, we need to know what to adjust and by how much.

Measurements are key

Measurements allow distinguishing good systems from bad ones. The final objective of measuring is to determine if the trading idea behind the system is worthwhile or useless.

Furthermore, measurements allow finding where the trading system is weak and optimising the inadequate parameter to a better value. For instance, we might observe that the system experiences sporadic large losses or that it faces too many whipsaws. Measurements allow searching the sweet spot where stops do its duty to protect our capital while preserving most of the profitable trades.

When the system is already trading live, we might use measurements to adapt it to the current conditions of the market. For example, an increase or decrease in volatility. Measurements help us detect when a system no longer performs as designed, by analysing the current statistical performance against its original or a reference.

Finally, keeping a trading record will help us assess proper risk management and position sizing, based on our objectives and the statistical properties of the developed system. This concept will be developed later on.

To gather information to make a proper analysis, we need to collect data. As much as possible.

Which kind of data do we need?

To answer this question, we need to, first, look at which kind of information do we really require.

As traders, we would like to have data about timing our entries, our exits and our stop-loss levels.

As for the entries we’d like to know if we are entering too early or too late. We’d need to know the answer to these questions also for the profit taking.

Finally, we’d wish to optimise the distance between entry and stop loss, which defines the dollar risk and the reward-to-risk ratio of the trade.

Proposed data to collect on each trade:

- Type of trade (long or short)

- Entry Date and time

- Price

- Planned Target price

- Effective exit price

- Exit date and time

- Maximum Adverse Excursion (MAE)

- Maximum Favourable Excursion(MFE)

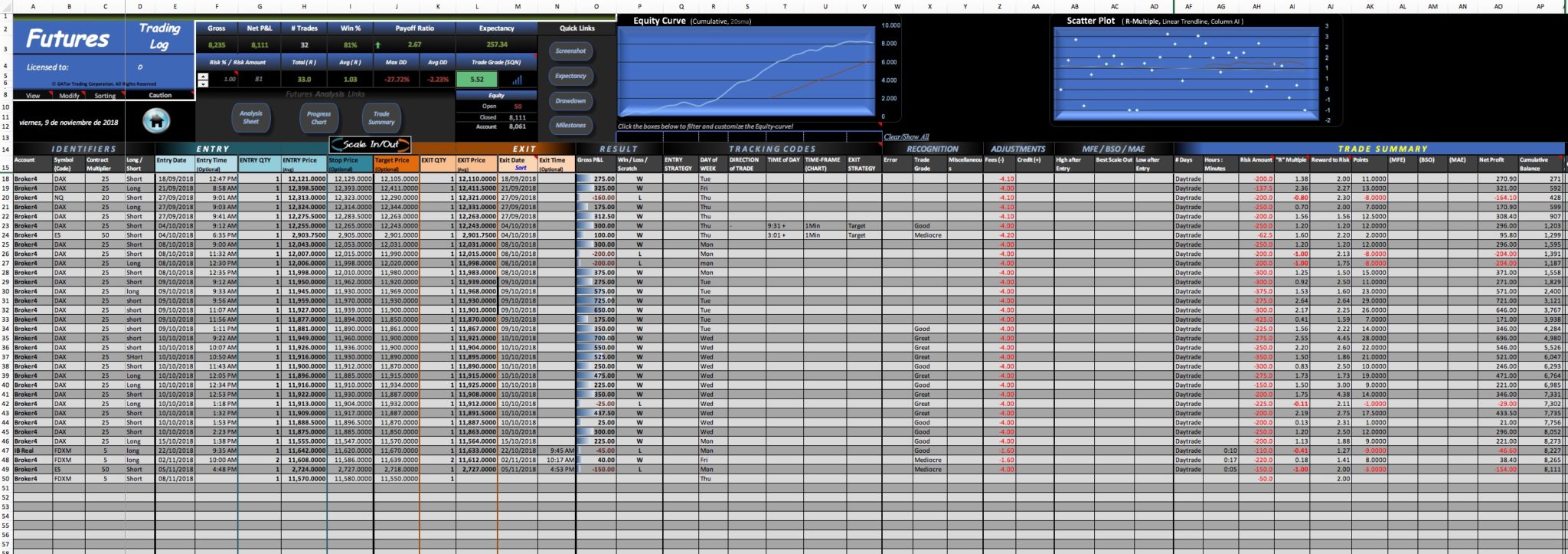

To provide you with more ideas about how to properly set up your own trading record, the figure below shows a professional trading record sample (click on it to enlarge).

Part IV will explain MAE and MFE and its importance in the performance of a trading system.

—————–

Take your trading to the next level with our 14 Day, No Obligation, Free Trial. You will soon discover why we are trading’s best-kept secret. We are successfully building the world’s largest group of profitable traders and would like you to be part of it.

You can join for as little as $19.99 per month, no contract, cancel anytime. This amount can be covered with just one profitable trade with us per month, the rest is pure profit. You will benefit from unparalleled access to our professional traders, our transparent trading performance, our LiveTradeRooms and access to the most comprehensive trading education on the market. What have you got to lose? JUST CLICK HERE TO GET STARTED NOW and see how real money is made!